Revel ™, FIT ®, Verve ® and Cerulean ® - Mastercard and the Mastercard ® acceptance mark are service marks used by The Bank of Missouri under license from Mastercard International. The card offers a $300 – $1000 initial credit.

The card can be used online, over the phone, and on the internet with millions of merchants. Other features of the card include zero fraud protection and added security for making purchases online. This allows cardholders to pay bills online, look at statements and account balances, and much more.Cerulean Credit Card reports to multiple credit bureaus. Use your card at locations everywhere that Mastercard is accepted. (subject to available credit and product approved) Fast and easy application process results are provided online. All credit types welcome to apply! Monthly reporting to the three major credit bureaus. The Cerulean Credit Card charges a cash advance fee of 3% (min $10). It's important to mention that cash advances can be very expensive. Please note that you are only allowed to withdraw a maximum of $200 per day and $100 per transaction.

The cash advance limit for the Cerulean Credit Card is 100% of the credit limit.Cards are issued by The Bank of Missouri and serviced by Continental Finance Company.

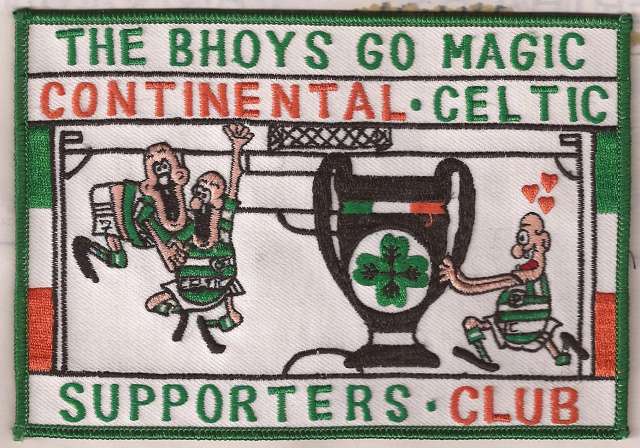

#CELTIC CONTINENTAL FINANCE FULL#

This card’s biggest perk is that you may not have to place a full cash deposit to match your credit limit (for example, a $500 deposit nets you a $500 credit limit).Revel ™, FIT ®, Verve ® and Cerulean ® - Mastercard and the Mastercard ® acceptance mark are service marks used by The Bank of Missouri under license from Mastercard International. The Capital One Platinum Secured Credit Card is our favorite second chance credit card for several reasons. Cards are issued by The Bank of Missouri and serviced by Continental Finance Company.Annual Fee.

0 kommentar(er)

0 kommentar(er)